The Solar Heating Market

The technical potential for residential applications of solar heating systems is 0.5-1.0 m² of solar collector/inhabitant.

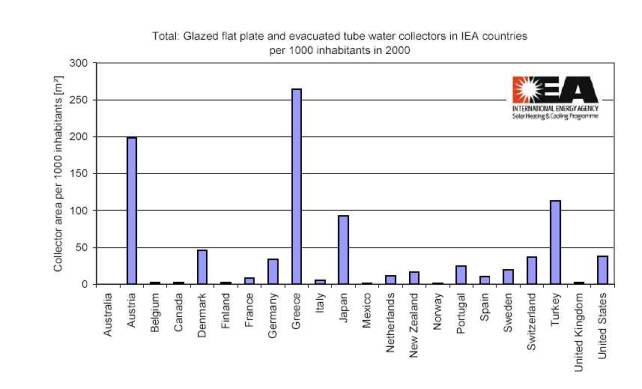

"Solar countries" such as Israel, Greece and Cyprus already have high "solar water heating penetration" (Israel has about 0.95 m² per inhabitant), whereas some of the best IEA countries Greece and Austria have a penetration of between 0.2 and 0.25 m² per inhabitant. The average solar penetration in IEA countries is roughly 0.04 m² per inhabitant; this would suggest that a strong growth of solar heating installations could be expected in the future. Driving forces for market development will be reduced costs and the desire to reduce greenhouse gas emissions.

A number of studies carried out by the IEA, the European Commission and in several countries reach a common conclusion: The market for solar water heaters is huge and - taken as a whole - is steadily growing, although the market growth will differ widely from country to country.

Currently, the most important solar application is for residential water heating. Today, systems for hot water production in single-family houses are dominant; although, in the future, solar heating systems will be used in all types of housing. In countries with centralised heating systems, such as district heating, large-scale solar energy systems will feed heat to the distribution network. Such systems have been successfully demonstrated in Scandinavia and Germany. Swimming pool solar systems, common in some countries, also present a large market.

Figure 1: The penetration (m² of collectors/1000 inhabitants) of glazed solar collectors in different IEA countries (ref. 1).

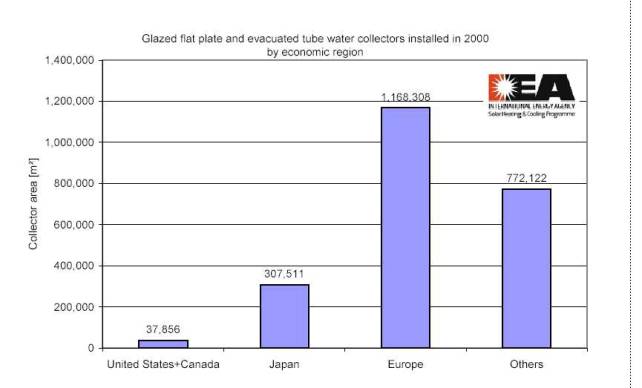

Figure 2. Year 2000 market of glazed solar collectors by region (ref 1)

Statistics Europe

Until the early 1990s the leading markets for solar collectors were in the Eastern Mediterranean area. Since 1990 the fastest growing markets for solar thermal have been in Northern Europe. Since 1993 Germany has been the single largest market in the EU. Austria has the largest annual per capita sales. In the latest years it is seen that more and more new markets like Italy and France has started to grow substantially.

Recent market studies for Europe show a market growth on 14% within the last decade.

The markets differ very much from country to country and in Europe - Germany, Austria and Greece accounts for more than 80% of the EU total.

European Target

The ambitious target for EC published in its “White Paper” from 1997 is to reach a number of 100 million installed m² of solar collectors in 2010.

The target of 15 million m² installed in 2003 is likely to be reached while the target of 100 million m² in 2010 will need an unlikely annual yearly market growth.

In the “Sun in action II” study (ref 2) is operating with two estimated scenarios

One with an annual growth of 11.7%, which is based on a continuation of the current policies. This scenario will reach a number of 46 million installed m² in 2015. Another realistic scenario assumes proactive policies are taken at the EC level and by each member state. This scenario will reach a number of 100 million installed m² in 20015 with an annual growth in market on 18%.

References:

-

IEA SHC programme: Solar Thermal Collector Market in IEA Member Countries, December 2002

-

European Solar Thermal Industry Federation: Sun in Action II – A Solar Thermal Strategy fort Europe, April 2003